Besides IBPS exams, SBI, RBI and NABARD conduct their own banking exams for recruitment

Bank jobs are often considered amongst the most monotonous jobs in India. The quotidian 9-5 routine, the mundane job profile and constant nature of work involved drives many people away from bank jobs in India. However, the advent of new fields such as investment banking and business consultancy has made the banking one of India's most coveted job sectors.

Last year alone, nearly 60,000 people were recruited for positions at government-funded banks from banking exams held by certain authorities. This increase in recruitment can be attributed to explosive growth in the number of branches each bank is opening for the convenience of customers in urban areas.

This rise is nothing short of remarkable, as the scope in banking sector was practically non-existent in the late 1980s. Liberalization of the Indian economy in 1991 changed the banking sector forever.

Whilst earlier major public sector banks did not bother to improve customer service or open new branches for customer convenience, private banks such as ICICI, HDFC, Global Trust Bank (now known as Oriental Bank of Commerce) etc, tapped into the demands of dissatisfied customers. This increase in competition prompted public sector banks to step up their game to keep customers from turning to private sector banks for their banking needs.

Nearly 26 years later, banks today are ready to bend upside down to satisfy customers. Facilities such as net and mobile banking, credit cards, De-MAT accounts and mutual fund investments have been made available to incorporate customers completely in the bank environment.

Banks: Functions and Positions

A bank is defined as the financial institution that accepts deposits from the public and creates credit and highly regulated in most of the countries due to their importance in the financial system and influence on national economies. Banca Monte dei Paschi di Siena (retail) and Berenberg Bank (merchant) are the 2 oldest existing banks in the history of banking. The Bank of England was the 1st to begin the permanent issue of banknotes in 1695. Activities of banks can be divided into 5: Retail Banking (deals directly with individuals and small businesses, Business (Provide services to mid-market business), Corporate (directed at large business entities), private (provide wealth management services to high-net-worth individuals and families) and investment (financial markets related activities). In the field of commerce and accounts, banking is one of the niche careers to pursue that is expanding rapidly. India has 93 commercial and 27 public sector banks out of which 19 are nationalized and 6 are SBI and its associate banks, and rest two are IDBI Bank and Bharatiya Mahila Bank, which are categorized as other public sector banks.

Some prospective careers in banking are :

Bank Probationary Officer (PO)

Financial Analyst

Account Manager

Specialist IT Officer

Marketing Officer (SO)

Law Officer (SO)

Rajbhasha Adhikar

Agricultural Field Officer

Minimum educational qualification required for appearing in banking exams:

Graduation in any discipline with knowledge of 1 local language.

At least a certificate/diploma in computer operations/language from an

Institute

Age limit is 20-28 years (+5 for SC/ST, +3 for OBC, +10 for disabled)

Scope of Banking Sector in India

The banking sector is considered to as the backbone of the Indian economy and offers various career opportunities to students from all fields: science, commerce humanities. You need to good in analyzing numbers with strong mathematics so that you can interpret and analyze numerical data. It is one of the lucrative careers especially for the people who are looking job in government sector.

The sector is in the huge need for manpower as Government of India is taking banking to remote areas also by opening new branches. It is also considered one of the socially respectable and secure job. In India, there are multiple examinations for bank jobs conducted by IBPS, State Bank of India and Reserve Bank of India (twice in a year). To clear these bank xaminations you need to be proficient in Reasoning, Aptitude, General knowledge, General English and Arithmetic topics. Communication and interaction with customers is most important in this field and hence gives you an exposure to different types of people with varied needs and lifestyles and enhances your confidence level as well in the long run.

IBPS (Institute of Banking Personnel Selection)

Institute of Banking Personnel Selection is an autonomous agency in India and started its operation in 1975 as Personnel Selection Services (PSS). It is registered under the Societies Registration Act, 1860 and also a Public Trust under the Bombay Public Trust Act, 1950. The Governing Board consists of nominees from Reserve Bank of India, Ministry of Finance Government of India, National Institute of Bank management, representatives of Public Sector Banks, Insurance sector, and academics. They offer services in 4 areas: Recruitment Projects, Promotion Projects, Admission Tests & Certification Exam Projects and Assessment Centres & Group Dynamics Related Personality Assessments, (including Group Exercises & Interviews). In 2011, IBPS announced a Common Written Examination (CWE) for the recruitment of officers and clerks in Indian banks and now the CWE test of IBPS is mandatory for anyone who seeks an employment in 29 sector and regional rural banks in India. It also offers human resource services to LIC, insurance companies, NABARD, IDBI, public sector undertakings and government departments. It is one of the best personnel selection test conducting agency in India.

Banking exams in India

Many aspirants of this question on their minds: How to start career in banking?

Public sector banks in India recruit professionals based on performance inÂ

banking exams conducted around the year. While some recruiters such as SBI and NABARD conduct their own separate banking exams, most public sector banks recruit employees through IBPS banking exams. The career options in banking on offer in most of these banking exams are:

IBPS Clerk: An employee who conducts general office tasks spanning all departments of a bank. They generally have to maintain the record filing, staffing service counters, screening specialists, and other regulatory tasks. Minimum age to appear in IBPS clerical banking exams is 20 years where applicants are trained on the job and gets an opportunity of sustainable learning in Banking, Finance, management, and other areas on his choice. It is one of the easiest jobs where you can enjoy the facilities provided by the government pensions after retirement, job security, allowances and low-interest loans.

IBPS Probationary Officer: It is the higher grade than a clerk, where you start as a trainee officer in the Junior Management Grade Service (JMGS) of the bank and can rise to the highest grades later on. PO is appointed for 2 years training probation period as an Assistant Manager in the bank to handle cash management, payments, reports, professional link building, customer service/relationship, document and account verification, etc. The selection process for PO post is completed in 2 steps: Common Written Examination and Interview of shortlisted Candidates.

IBPS Specialist Officer: SO mainly works in the back of the offices where they deal with the technical and human resources of the bank. To apply for this post you have to complete PG course at least in any specialized technical field. IBPS SO banking exams are held once in a year. Due to the advancement in technology, there is a need for specialized manpower (SO) in banking system who can handle modern technology banking products and services smoothly to increase the business of bank efficiently.

The top 10 banking exams conducted every year are listed below:

1. National Bank of Agriculture and Rural Development (NABARD)Grade A&B Banking exams

Established back in 1982, NABARD's principal purpose is to help rural enterprises flourish by providing necessary financial assistance and industrial guidance. Nearly all profits it makes are directed back to providing sustainable credit to rural industries and developing cottage, small scale and village industries. In a country where 17% of the GDP is derived from the agricultural sector, NABARD has played a crucial role in the growth spiral of the Indian economy.

Recruitment for NABARD is done for officers designated as Grade A and B. Banking exams are conducted by NABARD for both, grade A and B officer recruitment.

|

S. No |

Topic |

Weightage |

|

1. |

Reasoning |

20 |

|

2. |

General English |

40 |

|

3. |

Computer Aptitude |

20 |

|

4. |

Current Affairs |

20 |

|

5. |

Quantitative Aptitude |

20 |

|

6. |

Economic and Social issues |

40 |

|

7. |

Agriculture and Rural Development |

40 |

|

|

Total |

200 |

NABARD Grade A Mains Pattern is given below:

|

S. No |

Exam |

Position |

Topic |

Weightage |

Duration |

|

1. |

Phase I |

Common for all |

General English |

100 |

90 minutes |

|

2. |

Phase II |

For General Post |

Economic & Social Issues and Agriculture & Rural Development |

100 |

90 minutes |

|

For posts including following - Economics, Agriculture, Agriculture Engineering , Plantation and Horticulture, Animal Husbandry, Fisheries, Food Processing, Water Resource Development & Mgt, Social Work, CA and CS |

Specific Discipline |

|

S. No |

Exam |

Topic |

Weightage |

Duration |

|

1. |

Phase I |

General English |

100 |

90 minutes |

|

2. |

Phase II

|

Economic and Social Issues and Agri. and Rural Development (General Posts) |

100 |

90 minutes |

|

Agriculture (RDBS Agriculture Post) |

||||

|

3. |

Phase III |

Development Economics, Statistics, Finance & Management |

100 |

90 minutes |

Both preliminary and mains banking exams are conducted in online mode. Shortlisted candidates after Mains exams are called up for the interview after which final selection is done.

2. State Bank of India Probationary Officer (SBI PO) Banking Exams

One of the oldest public sector banks in India, SBI is amongst the country's most reliable banks. SBI has the highest number of branches in the country, spanning the smallest townships to the largest metropolitan cities. It is often considered a trendsetter when it comes to setting interest rates for home loans, car loans and other personalized loan packages.

Unlike other banks, SBI does not accept IBPS banking exam scores and conducts its own PO and clerkship exams. SBI PO banking exams are held in July every year in an objective based format. Like most banking exams, SBI PO is conducted in two stages, preliminary and mains.

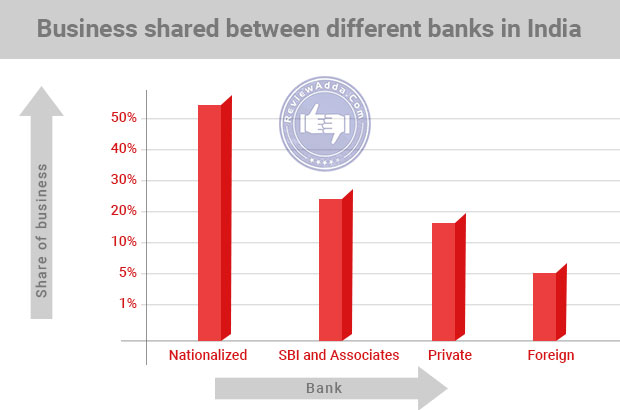

National banks still reign supreme amongst other sectors in India

|

Section |

Number of questions |

Weightage |

Duration |

|

General English |

30 |

30 |

60 minutes |

|

Quantitative Aptitude |

35 |

35 |

|

|

Reasoning Ability |

35 |

35 |

|

|

TOTAL |

100 |

100 |

|

Section |

Number of questions |

Marks |

Time |

|

Reasoning and Computer Knowledge |

45 |

60 |

60 min |

|

Data Analysis and Interpretation |

35 |

60 |

45 min |

|

Knowledge of banking and economy |

40 |

40 |

35 min |

|

General English |

35 |

40 |

40 min |

|

TOTAL |

155 |

200 |

3 hours |

The written exam is followed by a descriptive test entailing letter/essay writing lasting 30 minutes and amounting to 50 marks. Candidates who clear Mains objective and descriptive test are called up for GD and PI round. After its conclusion, the final list of selected students is released.

Get Updated Review ( Voice Based Alumni Feeback)

Get Updated Review ( Voice Based Alumni Feeback)

-

Check Review (Alumni Feedback) - BML Munjal University – Click Here

Check Review (Alumni Feedback) - BML Munjal University – Click Here -

Check Review (Alumni Feedback) - UPES Dehradoon – Click Here

Check Review (Alumni Feedback) - UPES Dehradoon – Click Here -

Check Review (Alumni Feedback) - DIT University Dehradoon – Click Here

Check Review (Alumni Feedback) - DIT University Dehradoon – Click Here -

Check Review (Alumni Feedback) - SRM University Sonipat – Click Here

Check Review (Alumni Feedback) - SRM University Sonipat – Click Here -

Check Review (Alumni Feedback) - Ansal University – Click Here

Check Review (Alumni Feedback) - Ansal University – Click Here

3. SBI Clerkship exam Banking Exams

A clerkship at SBI entails handling general operations in all departments of a given bank. These operations range from interacting with customers to working at cash counters and assisting POs. SBI preliminary clerkship banking exams are held in August every year. Clerks can be promoted to Pos after internal evaluation based on performance and interview.

|

S.No |

Topic |

Number of Questions |

Weightage |

|

1. |

English Language |

30 |

30 |

|

2. |

Mathematical Ability |

35 |

35 |

|

3. |

Reasoning Ability |

35 |

35 |

|

TOTAL |

|

100 |

100 |

The exam is 60 minutes long and has 0.25 negative marking.

|

S. No |

Topic |

Number of questions |

Weightage |

Duration |

|

1. |

General English |

40 |

40 |

35 minutes |

|

2. |

Quantitative Aptitude |

50 |

50 |

45 minutes |

|

3. |

Reasoning and Computer Aptitude |

50 |

60 |

45 minutes |

|

4. |

Financial Awareness |

50 |

50 |

35 minutes |

|

|

TOTAL |

190 |

200 |

2 hr 45 min |

Candidates for interview are shortlisted based purely on performance in Mains exam. Results of the interview are made available on SBI's website.

4. Reserve Bank of India (RBI) Grade B officer Banking exams

One of the most prestigious banking organizations in India, RBI offers one of the most dynamic and challenging career opportunities in the banking sector. Unlike other banks were the job description has consistency, working for RBI requires a more dynamic approach. RBI Grade B officer banking exams is conducted in September every year in two stages: preliminary and mains.

|

S. No |

Topic |

Number of Questions |

Weightage |

|

1. |

Current Affairs |

80 |

80 |

|

2. |

General English |

30 |

30 |

|

3. |

Quantitative Aptitude |

30 |

30 |

|

4. |

Reasoning Ability |

60 |

60 |

|

|

TOTAL |

200 |

200 |

|

S. No |

Topic |

Format |

Weightage |

Duration (min) |

|

1. |

Economic and Social Issues |

MCQ |

100 |

90 |

|

2. |

English (Writing) |

Subjective |

100 |

90 |

|

3. |

Finance and Management |

MCQ |

100 |

90 |

After Phase II, candidates are shortlisted for interview round based on performance in Mains. Interview carries 50 marks during final selection.

5. Institute of Banking Personnel Selection Probationary Officer (IBPS PO) Banking Exams

IBPS examinations began in 1975 with the sole purpose of finding qualified professionals to work in the banking sector. Nearly all public sector banks recruit bankers based on their respective performance in IBPS examinations. Like other banking exams, IBPS also conducts PO examinations in two stages: preliminary and mains. The preliminary exam is held in October every year.

|

Topic |

Number of questions |

Weightage |

|

General English |

30 |

30 |

|

Quantitative Aptitude |

35 |

35 |

|

Reasoning Ability |

35 |

35 |

|

TOTAL |

100 |

100 |

The exam is one hour long has 0.25 negative marking for every wrong answer. The IBPS PO Mains pattern was amended this year to increase the difficulty of the exam.

|

Section |

Number of questions |

Weightage |

Duration (min) |

|

Reasoning skills and Computer Aptitude |

45 |

60 |

60 |

|

General English |

35 |

40 |

40 |

|

Data Analysis and Interpretation |

35 |

60 |

45 |

|

General Banking and Finance knowledge |

30 |

40 |

35 |

|

TOTAL |

155 |

200 |

180 |

After objective phase, candidates will appear for a descriptive test carrying 50 marks and lasting 30 minutes. The written banking exams is followed by a PI round carrying 20% weightage for final selection.

IBPS Clerkship Banking Exams

Banks beside SBI hire clerks based upon performance in IBPS Clerkship banking exams. The exam is held in November every year and is conducted in two phases: preliminary and mains.

|

Topic |

Number of Questions |

Weightage |

Duration |

|

General English |

30 |

30 |

One hour |

|

Mathematical Aptitude |

35 |

35 |

|

|

Reasoning Ability |

35 |

35 |

|

|

TOTAL |

100 |

100 |

|

The exam has 0.25 negative marking for every incorrect answer.

|

Topic |

Number of Questions |

Weightage |

Time allotted (min) |

|

Reasoning and Computer knowledge |

50 |

60 |

45 |

|

General English |

40 |

40 |

35 |

|

Quantitative Aptitude |

50 |

50 |

45 |

|

Banking and Financial Awareness |

50 |

50 |

35 |

|

TOTAL |

160 |

200 |

160 |

There is no interview or GD round as candidates are selected purely on the basis of performance in Mains exam.

IBPS Regional Rural Banks (RRB) Officer Scale 1Banking Exams

Besides public sector bank, the inception of several regional rural banks has helped provide banking services in the most remote places in India. The preliminary exam is conducted in November every year followed by the Mains exam.

|

Topic |

Number of questions |

Weightage |

Time allotted |

|

Reasoning Ability |

40 |

40 |

45 minutes |

|

Quantitative Aptitude |

40 |

40 |

|

|

TOTAL |

80 |

80 |

|

The exam carries 0.25 negative marking for every incorrect answer.

|

Topic |

Number of Questions |

Marks |

Time allotted |

|

Reasoning skills |

40 |

50 |

Two Hours |

|

Quantitative Ability |

40 |

50 |

|

|

Current Affairs |

40 |

40 |

|

|

English/Hindi (General) |

40 |

40 |

|

|

Computer Skills |

40 |

20 |

|

|

TOTAL |

200 |

200 |

|

The Mains exam is followed by a shortlist for PI round. Selection is done on the basis of performance in Mains and PI only.

IBPS RRB Office Assistant Banking Exams

Similar to the job profile of clerks, Office assistants are essentially clerks for regional banks. The recruitment process is conducted in two phases: preliminary and mains banking exams. No PI round is conducted after Mains.

|

Topic |

Number of questions |

Weightage |

Time allotted |

|

Reasoning Ability |

40 |

40 |

45 minutes |

|

Quantitative Aptitude |

40 |

40 |

|

|

TOTAL |

80 |

80 |

|

|

Topic |

Number of Questions |

Marks |

Time allotted |

|

Reasoning skills |

40 |

50 |

Two Hours |

|

Quantitative Ability |

40 |

50 |

|

|

Current Affairs |

40 |

40 |

|

|

English/Hindi (General) |

40 |

40 |

|

|

Computer Skills |

40 |

20 |

|

|

TOTAL |

200 |

200 |

|

Final selection is done only on the basis of Mains score. Each wrong answer carries a negative 0.25 penalty.

9. NABARD Development Assistant Banking Exams

NABARD also offers clerkship programmes in the form of Development Assistant posts. Like clerks at SBI and other banks, development assistants help managers and officers in managing day-to-day operations, making reports and completing data entry tasks. The exam procedure involves two different phases: preliminary and mains. The preliminary exam is conducted in November every year.

|

Topic |

Number of Questions |

Weightage |

Duration |

|

General English |

40 |

40 |

One hour |

|

Mathematical Aptitude |

30 |

30 |

|

|

Reasoning Ability |

30 |

30 |

|

|

TOTAL |

100 |

100 |

|

|

Topic |

Number of Questions |

Marks |

Time allotted |

|

Reasoning skills |

30 |

30 |

Two Hours |

|

Professional Hindi |

30 |

30 |

|

|

Current Affairs (more emphasis on banking, finance and agriculture) |

50 |

50 |

|

|

Computer Skills |

40 |

40 |

|

|

Descriptive Test (English) |

Essay/Letter writing |

50 |

|

|

TOTAL |

|

200 |

|

Final selection will be done only on the basis of performance in Mains banking exams as no PI round is conducted for this post.

10. RBI Office Assistant Banking Exams

One of the most illustrious clerkships in the banking sector, RBI offers office assistant programmes to aspiring banking professionals in India. Besides data entry jobs, working at RBI even as an assistant molds a candidate into handling challenging jobs easily in the future. The preliminary banking exams for RBI assistantship are conducted in December every year.

|

Topic |

Number of Questions |

Weightage |

Duration |

|

General English |

30 |

30 |

One hour |

|

Mathematical Aptitude |

35 |

35 |

|

|

Reasoning Ability |

35 |

35 |

|

|

TOTAL |

100 |

100 |

|

Each wrong answer carries 0.25 negative marks.

The exam pattern for RBI Office Assistant mains exam is tabulated below:

|

Topic |

Number of Questions |

Marks |

Time allotted |

|

Reasoning skills |

40 |

40 |

Two Hours |

|

General English |

40 |

40 |

|

|

Mathematical Ability |

40 |

40 |

|

|

Computer Skills |

40 |

40 |

|

|

Current Affairs |

40 |

40 |

|

|

TOTAL |

200 |

200 |

|

Candidates who clear Mains cutoff are called up for PI round. Final recruitment is done on the basis of Mains score and interview.

Banking Sector: The future

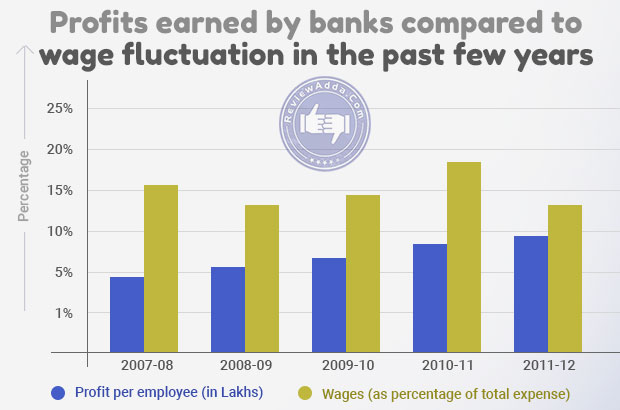

Bank wage percentage compared to total expense has gained stability with rise in profit

The shift towards online banking has sent jitters down some future banking professionals. With automation slated to be a reality soon, one does wonder whether jobs at banks will eventually dry up. However, the shift to back table jobs like KPOs, investment banking and financial analysis has opened new opportunities in this sector.

This trend is expected to continue as banking changes gears and moves to an area with even more opportunities. The emergence of investment banks dedicated to market trends and analysis is expected to launch the banking sector into stratosphere.

There has never been a better time to be a banker. New dynamic fields with incredible payoffs and commissions are slated to make banking the most coveted field in India.